Explainer: Mayor Adams Still Wants to ‘Axe the Tax’ for Some New Yorkers

Ahead of this year's mayoral election, Mayor Adams pushes tax relief for low-income families sparking both praise and skepticism.

Mayor Eric Adams has doubled down on his “Axe the Tax for the Working Class” initiative, a plan that would eliminate New York City's personal income tax for families earning up to 150% of the federal poverty level.

In a recent call-in to the 94.7 The Block's "Jonesy in the Morning" radio show, the mayor highlighted his administration’s continued efforts to bring economic relief to New Yorkers while navigating a politically charged year.

“If there's a mother that's making $31,000 a year, and she has a child, she would no longer have to pay a city income tax,” said Adams, speaking with host Tarsha Jones. “We call it ‘money in your pocket’ because that’s exactly what it is, direct relief for working-class New Yorkers.”

Who would qualify for the tax relief?

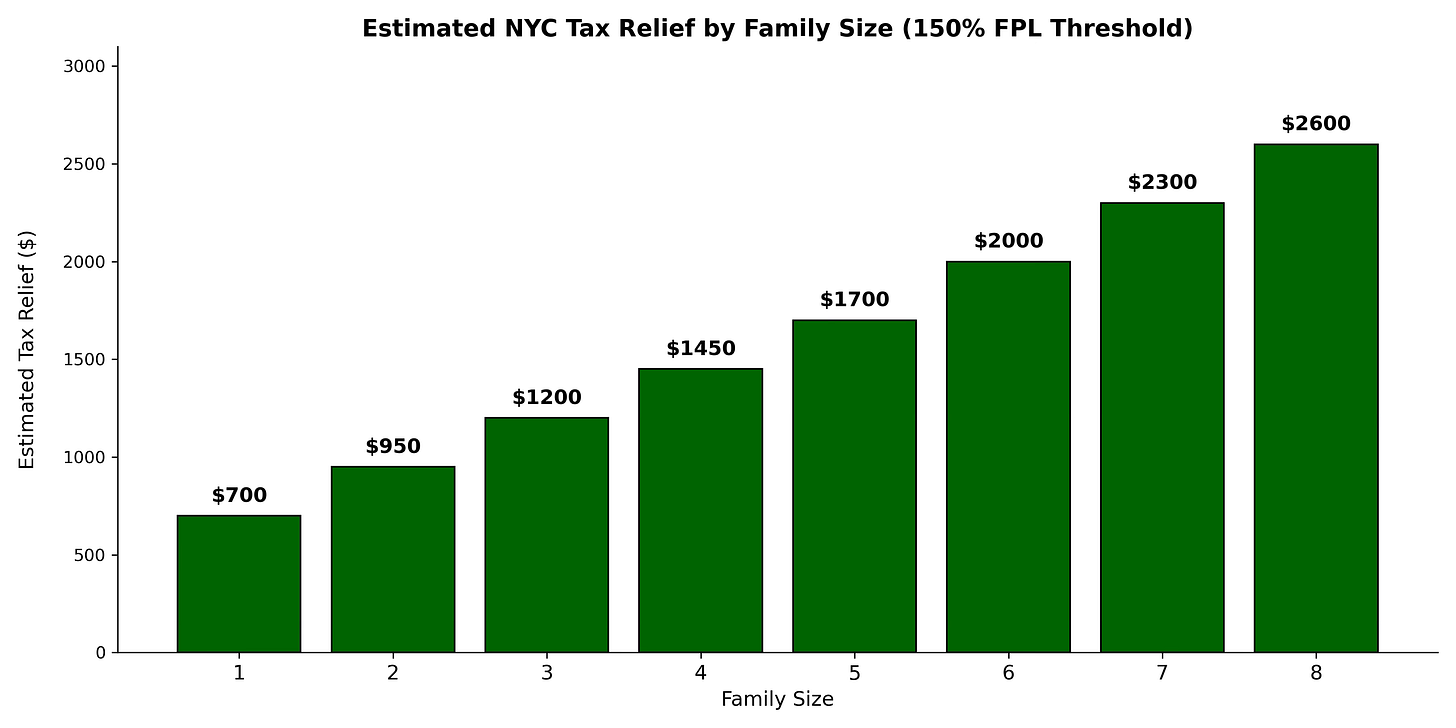

Eligibility for the program would be based on annual income and household size. The plan would use the federal poverty level (FPL) as a benchmark:

For a single individual, 150% of the FPL is approximately $22,590 per year.

For a family of four, 150% of the FPL is around $46,800 per year.

Families earning below these thresholds would either see their city income taxes significantly reduced or eliminated altogether. The exact income thresholds and savings will depend on household size and other factors.

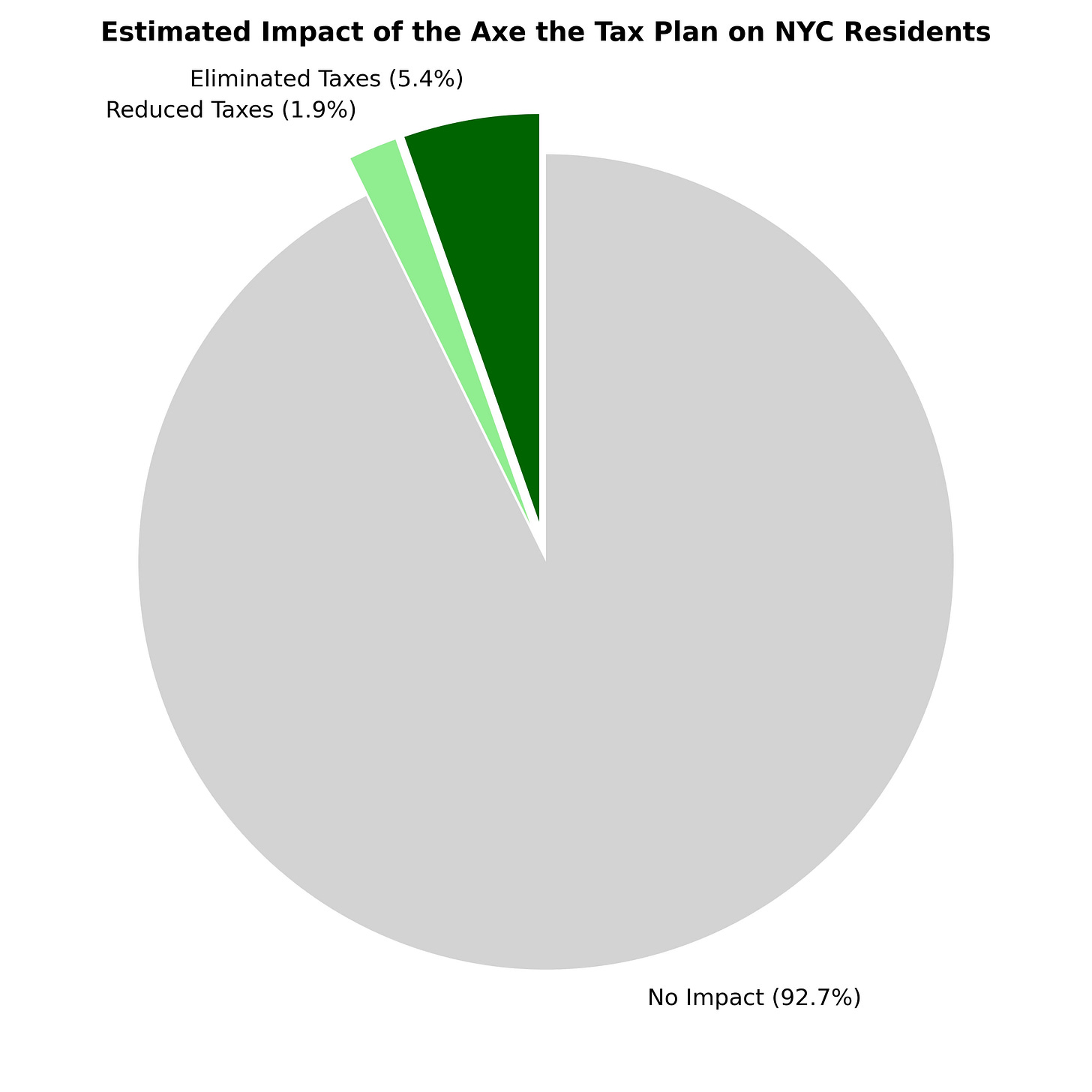

How many New Yorkers would benefit?

Approximately 582,000 New Yorkers are expected to benefit from the "Axe the Tax" initiative:

429,000 residents would see their city income tax eliminated entirely.

An additional 152,500 residents would see reduced taxes.

According to the mayor’s office, the average household would save around $350 annually, but savings could be higher for larger families or those close to the income thresholds.

What’s next? Could the tax relief come this year?

The plan requires state-level approval, as New York City’s income tax system is integrated with state law. Mayor Adams has already submitted the proposal to state legislators in Albany.

The "Axe the Tax" proposal will now be debated in the state legislature as part of the upcoming budget process. If approved, New Yorkers could begin to see these changes reflected in their taxes in the 2025 filing season.

Mayor Adams is expected to provide more details of the plan in his upcoming State of the City address, scheduled for January 9th, where he is expected to outline his broader vision for New York City.

For now, the proposal has sparked a lively debate, with supporters calling it a game-changer for working families and critics warning of fiscal risks.

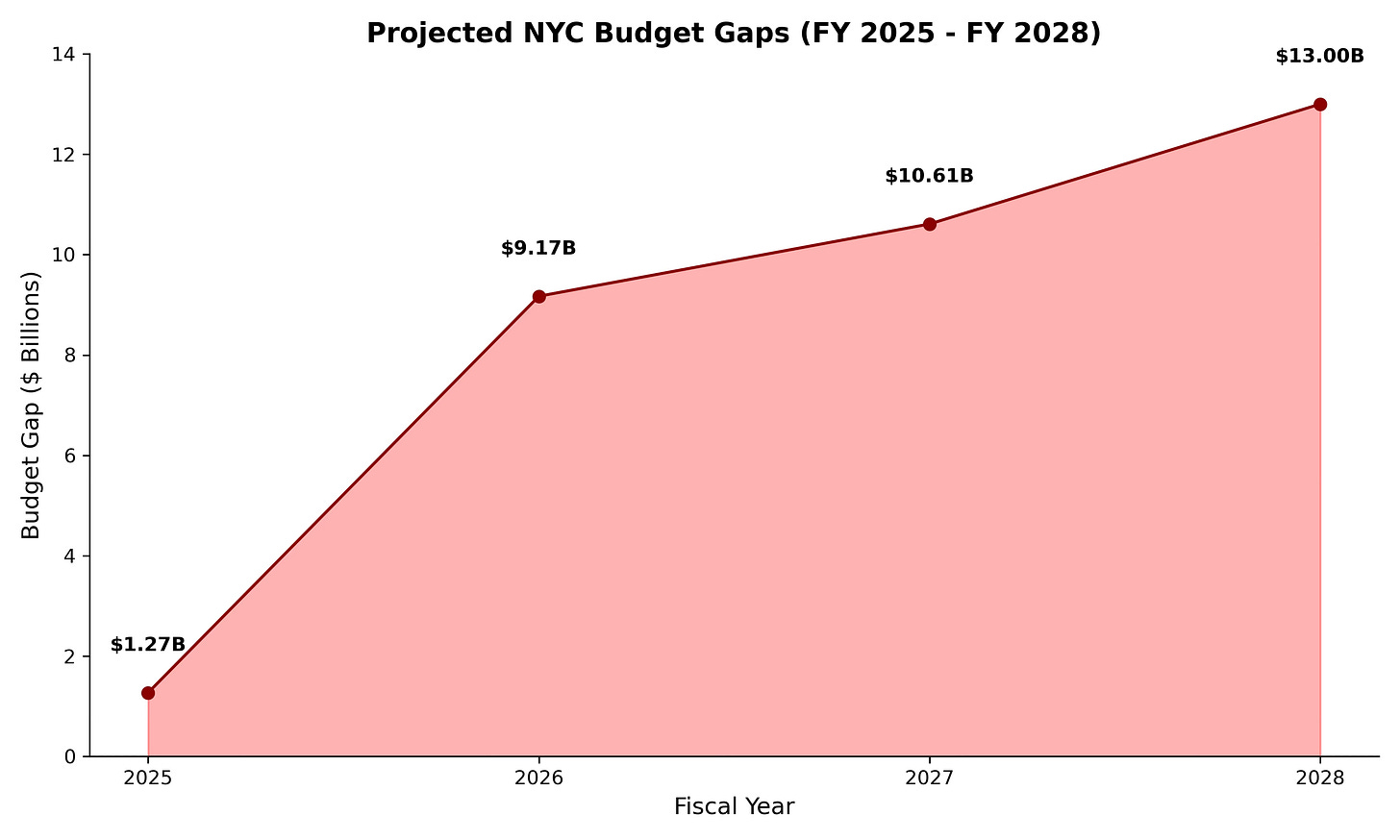

"New York City is facing a fiscal year 2026 budget gap approaching $9 billion,” said Andrew Rein, president of the Citizens Budget Commission, a non-profit organization based in New York City that analyzes and advocates for sound fiscal policies.

Residents have mixed feelings about the proposal.

“I think it’s great for low-income families,” said Marcus Reid, a Queens father of three. “But what about middle-income folks like me? We’re also struggling, and we don’t qualify for this.”

Some question how the plan will be implemented and how the deficit would be made up.

“I support the idea, but what’s the backup?” asked Maria Alvarez, a Brooklyn resident. “If it means higher property taxes or cuts to public schools, then it’s not worth it.”

While the mayor’s proposals have garnered praise for their potential to provide direct financial relief, they also face scrutiny, particularly given the city's ongoing budget challenges.

The timing of the announcement has not gone unnoticed, as 2025 is an election year, and Adams is expected to seek re-election.

“All you gotta do is pass a bill, give New Yorkers some money or some tax incentive, and you're good for another four," said Jones jokingly, capturing the high stakes of the mayoral race.

Whether the plan is ultimately embraced as part of Adams' vision for New York City or dismissed as an election-year maneuver will likely depend on its reception in Albany, and in the court of public opinion.

What’s clear is that the mayor’s proposal has sparked a citywide conversation about how to best support working-class New Yorkers in an increasingly expensive city.